|

Expolanka Holdings PLC announced on Thursday 9th July, a 0.12/- per share interim dividend for the financial year 2015/16.

This is the first dividend after the 2nd interim dividend of 0.21/- paid for the year 2013/14 in January 2014. EXPOLANKA HOLDINGS - DIVIDEND ANNOUNCEMENT EXPOLANKA HOLDINGS PLC Company ID: - EXPO Date of Announcement: - 09.Jul.2015 Dividend per Share: - Rs. 0.12 per share / Interim Dividend Financial Year: - 2015/2016 XD: - 20.Jul.2015 Payment: - 29.Jul.2015 Share Transfer Book Open Asiri Hospital Holdings (ASIR) yesterday announced the completion of the sale and transfer of the land in Horton Place, Colombo 07, owned by Asiri Central Hospitals Ltd. (a subsidiary of ASIR) for a total consideration of Rs. 2.7 billion.

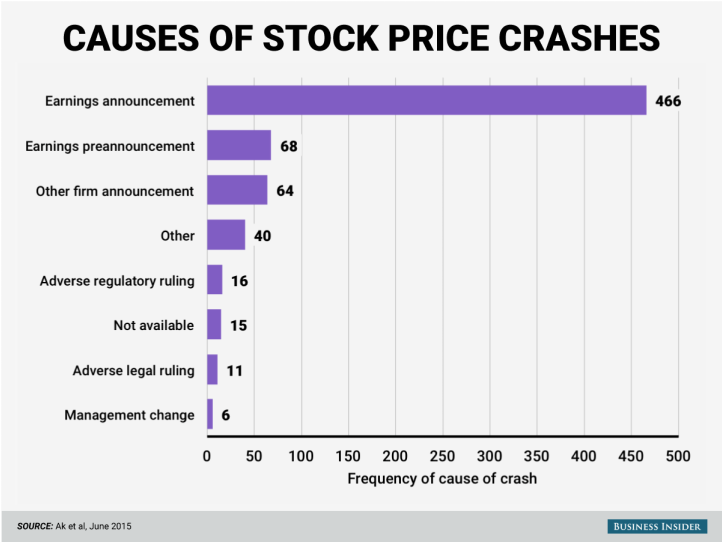

The decision to sell the land spanning 293 perches was first announced in August last year. In the fourth quarter of FY15 a gain of Rs. 513.4 million was recorded as change in fair value of investment property of Asiri Central Hospital at Horton Place. Source: ft.lk  A study by B. Korcan Ak and Richard Sloan of the University of California at Berkeley and Steve Rossi and Scott Tracy of RS Investments analyzed stock data to try to determine what kinds of events and firm characteristics are associated with stock crashes. The researchers came up with three statistical measures of stock price crashes, each of which captured a sudden drop in a company's stock price in a given time period. The simplest of the measures was the worst daily return for the stock's price in the given time period. The second measure flagged whether or not a stock's return on a day was extremely below the average return for that stock. The third measure looked at the overall distribution of a stock's daily returns and how far skewed to the downside that distribution was: A negatively-skewed return distribution is an indicator of one or more really bad days for a stock's price. Looking at stock return data for companies in the S&P US Broad Market Index for the four six-months periods ranging from July 2012 through June 2014, they identified 686 severe stock price crash events in which a company's score on at least one of their three indicators was in the lowest-performing 5% among all stocks. Ak and his colleagues then manually looked through media reports for each of those crashes to figure out what caused the crashes. They found that the vast majority of crashes came right after the release of earnings statements or earnings pre-statements. The next biggest cause was other firm announcements, which they noted mostly consisted of failed clinical trials for health care companies: Read more: http://www.businessinsider.com/why-stock-prices-crash-2015-7#ixzz3eettgRgv |

Archives

July 2015

Categories

|

RSS Feed

RSS Feed